If you’ve ever wondered whether precious metals belong in your investment portfolio, you’re asking exactly the right question at exactly the right time. Today, I’m breaking down ‘What is the best way to invest in precious metals’, not the theoretical academic stuff, but the practical, real-world approaches that work for different types of investors.

Understanding the Precious Metals Landscape

Before we get into specific investment methods, you need to understand what you’re actually dealing with here. Precious metals are legitimate financial assets with distinct characteristics that differ from those of traditional investments.

The four main precious metals investors consider are gold, silver, platinum, and palladium. Gold gets most of the attention because historically it has been viewed as the ultimate store of value and inflation hedge.

Silver occupies an interesting dual role as both a monetary metal and an industrial commodity, creating unique price dynamics.

Platinum and palladium are primarily industrial metals used heavily in automotive catalytic converters, though platinum also has investment demand.

What makes precious metals particularly interesting right now is their low correlation with traditional financial assets. When stock markets get turbulent or when inflation concerns emerge, precious metals often move independently or even inversely to equities.

This pattern has held up reasonably well over long time periods.

Here’s a look at historical gold and silver prices to illustrate long-term trends:

The key insight here is that precious metals serve as wealth preservation and portfolio diversification tools. You’re not going to see the dramatic growth potential you might get from tech stocks, but you’re also not likely to see your precious metals investment go to zero the way a company stock can.

And this chart shows the market share breakdown among precious metals:

Physical Bullion: The Foundation Approach

Let’s start with the most tangible way to invest, actually owning physical metal. This means buying coins or bars and either storing them yourself or paying someone else to store them securely.

Physical bullion comes in two main categories. Coins are produced by government mints and include popular options like American Gold Eagles, Canadian Maple Leafs, Austrian Philharmonics, and South African Krugerrands.

Bars are typically produced by private refiners and come in various sizes, from 1-ounce gold bars to 400-ounce gold bars or 1000-ounce silver bars.

The advantage of physical ownership is straightforward: You actually possess the asset. There’s no counterparty risk, no reliance on financial institutions, and no worry about paper promises not being fulfilled. If the financial system experiences a serious disruption, you’ve got actual metal you can hold in your hand.

When you buy physical bullion, you’ll pay a premium over the spot price. This premium covers the costs of minting, distribution, and dealer markup.

For gold coins, premiums typically range from 3 to 7% over spot, though this varies by market conditions and specific products.

Silver premiums tend to be higher on a percentage basis because the metal itself is cheaper, so the fixed costs of production represent a larger percentage of the total price.

The real challenge with physical bullion is storage and insurance. If you keep it at home, you need a really good, safe, and adequate insurance coverage.

Most homeowners’ insurance policies have pretty low limits on precious metals coverage, often just a few thousand dollars, so you’ll likely need a separate policy rider or specialized insurance.

Home storage also creates personal security concerns that you need to take seriously.

Professional storage through a bullion depository is the alternative. Companies like Brinks, Delaware Depository, and others offer allocated storage where your specific coins or bars are segregated and identified as yours.

This typically costs between fifty cents and a dollar per hundred dollars of value annually.

Some dealers also offer unallocated storage, which is cheaper but means you don’t own specific pieces of metal; you just have a claim on the dealer’s inventory.

The liquidity of physical bullion is decent but not perfect. You can sell coins and bars back to dealers, but you’ll face bid-ask spreads.

Dealers typically buy back at a slightly below-spot price while selling at a premium over spot.

This spread represents a transaction cost that eats into returns, especially for short holding periods.

Ready to purchase physical bullion? Explore options with Noble Gold Investments at https://noblegoldinvestments.com/.

Precious Metals ETFs: The Convenient Modern Approach

Exchange-traded funds have really revolutionized precious metals investing over the past two decades. These funds hold physical metal in vaults and issue shares that trade on stock exchanges just like regular stocks.

The most popular gold ETF is SPDR Gold Shares (GLD), which holds hundreds of tons of gold bullion stored in London vaults. For silver, iShares Silver Trust (SLV) serves a similar function.

There are also ETFs for platinum, palladium, and even funds that hold baskets of many precious metals.

The beauty of ETFs lies in their combination of liquidity and simplicity. You can buy or sell shares instantly during market hours through any brokerage account.

There’s no need to worry about storage, insurance, or security.

The expense ratios are relatively low, typically around 0.4 to 0.5 percent annually, and the funds handle all the logistics of storing and insuring the physical metal.

ETFs also allow for much more flexible position sizing. You can invest a few hundred dollars just as easily as a few hundred thousand.

Try doing that with physical gold bars, where you’re looking at spending tens of thousands of dollars for a single standard bar.

The tradeoff is that you don’t actually possess the metal. You own shares in a trust that owns metal.

In extreme scenarios, and I mean really extreme, not normal market volatility, there could theoretically be issues with the trust structure.

Additionally, ETF shares are treated as collectibles for tax purposes, meaning long-term capital gains are taxed at a maximum rate of 28% rather than the more favorable 15% or 20% rate for stocks.

Some investors also worry about the authenticity and actual existence of the metal backing ETFs. The major funds publish audited reports and maintain insurance, but if you’re the type who needs to physically touch your investment, ETFs probably won’t give you the peace of mind you’re looking for.

Mining Stocks: Leveraged Exposure with Company Risk

Buying shares in companies that mine precious metals gives you indirect exposure to metal prices, but with significantly different characteristics than owning the metals themselves.

When gold prices rise, mining companies often see their profits increase by a much larger percentage. This happens because miners have substantial fixed costs, so increases in the price of their product flow more directly to the bottom line.

If a mining company produces gold at an all-in sustaining cost of thirteen hundred dollars per ounce and gold is trading at eighteen hundred dollars, they’re making five hundred dollars per ounce.

If gold rises to two thousand dollars, their profit per ounce increases to seven hundred dollars, a forty percent increase from a roughly eleven percent increase in gold prices.

This leverage works both ways, of course. When gold prices fall, mining stocks tend to fall even harder.

You’re also taking on all the normal risks of equity investing, management quality, operational challenges, labor disputes, permitting issues, reserve depletion, and everything else that can go wrong with a business.

The major gold mining companies include Newmont, Barrick Gold, and Agnico Eagle. These are large, established operations with many mines and relatively predictable production profiles.

Junior mining companies are smaller, often with just one or two projects, and they carry significantly higher risk and higher potential returns if they make major discoveries or bring new mines into production.

A middle ground between owning person mining stocks and owning the metals directly is investing in mining-focused ETFs like VanEck Gold Miners ETF (GDX) or the junior-focused GDXJ. These funds hold portfolios of mining companies, providing diversification within the mining sector.

One significant advantage of mining stocks is the tax treatment. Unlike physical metals or ETFs backed by physical metals, mining stocks are taxed as regular equities with more favorable long-term capital gains rates.

Some mining companies also pay dividends, providing income that you’ll never get from holding inert metal.

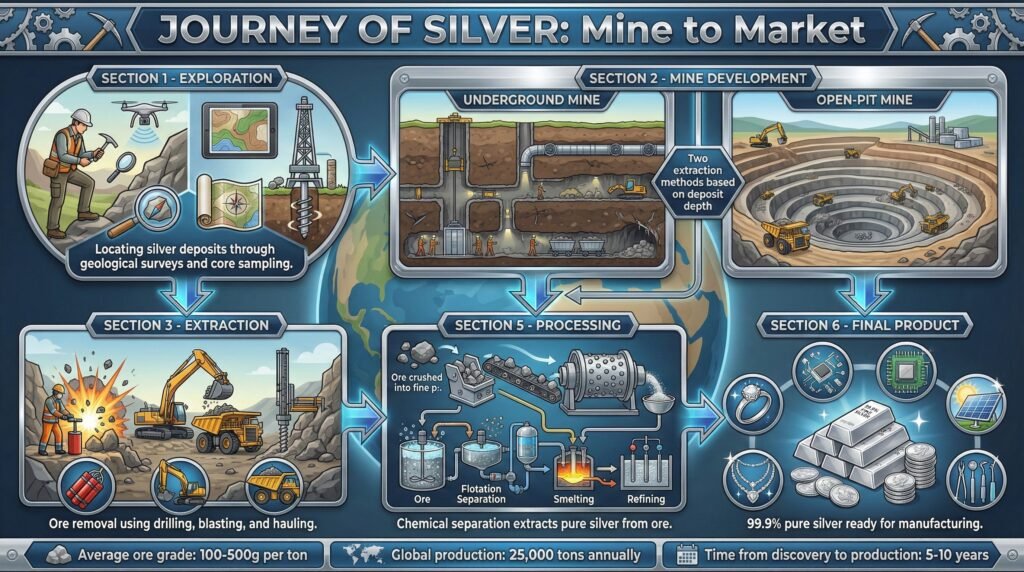

Visualize a typical silver mining operation:

Streaming and Royalty Companies: A Unique Hybrid

There’s a really interesting category of precious metals investment that most people don’t know about: streaming and royalty companies. These businesses provide upfront capital to mining companies in exchange for the right to purchase a portion of future production at reduced prices or to receive royalty payments based on production.

Companies like Franco-Nevada, Wheaton Precious Metals, and Royal Gold operate this model. They essentially act as specialized financiers to the mining industry, but with the upside exposure to precious metals prices.

The advantage of this model is that streaming companies get metal price exposure without the operational risks of actually running mines. They don’t deal with labor issues, equipment breakdowns, permitting challenges, or the massive capital expenditures required to develop new mines.

They’ve essentially outsourced those operational headaches while retaining the financial benefits.

These companies also tend to have diversified portfolios of streaming agreements across many mines and metals, which reduces single-project risk. Many have exposure to both precious and base metals, as well as other commodities, further diversifying their revenue streams.

The downside is that you’re adding a layer of financial structure between you and the underlying metals. You’re dependent on the quality of the streaming contracts, the financial health of the operating mining companies, and the management decisions of the streaming company.

Still, for investors who want precious metals exposure with less volatility than junior miners but more upside potential than physical metals, streaming companies occupy an interesting middle ground.

Precious Metals IRAs: Tax-Advantaged Physical Ownership

Self-directed IRAs that hold physical precious metals represent an interesting combination of physical ownership with tax-advantaged treatment. These specialized retirement accounts allow you to own actual bullion coins and bars within an IRA structure, meaning your gains grow tax-deferred or tax-free depending on whether you use a traditional or Roth IRA.

Setting up a precious metals IRA requires working with a specialized custodian who handles the account administration and confirms compliance with IRS regulations. The IRS has specific requirements about which products qualify. Generally, coins and bars must meet at least fineness standards, and collectible or numismatic coins typically don’t qualify.

The metal must be stored in an approved depository. You can’t keep it at home while claiming IRA treatment.

This means you’ll pay both custodian fees and storage fees, which typically run a few hundred dollars annually for account administration plus a percentage of assets for storage.

The tax advantage can be significant for larger long-term precious metals positions. In a traditional IRA, you remove contributions and pay ordinary income tax on withdrawals.

In a Roth IRA, you pay taxes upfront, but qualified withdrawals are tax-free.

Either way, you avoid the capital gains taxes you’d face with precious metals held in taxable accounts.

The trade-offs include extra fees, restricted access to your metal, and the fact that your money is locked up until retirement age unless you pay early withdrawal penalties. For investors who are already maximizing other retirement accounts and want precious metals as part of their long-term retirement strategy, precious metals IRAs make sense.

For those who want more flexibility or are just getting started with precious metals investing, they’re probably not the first approach to consider.

Interested in a precious metals IRA? Get started with Noble Gold Investments, experts in gold and silver IRAs: https://noblegoldinvestments.com/.

Determining Your Optimal Precious Metals Allocation

The big question is how much of your portfolio should actually be in precious metals. There’s no universal answer, but there are some reasonable guidelines based on your investment goals and risk tolerance.

Traditional portfolio theory suggests something in the range of five to ten percent for precious metals as a portfolio diversifier and inflation hedge. This is enough to provide meaningful benefit if metals perform well during periods when your other assets struggle, but not so much that you’re overly concentrated in non-income-producing assets.

Conservative investors focused primarily on wealth preservation might lean toward the higher end of that range or even a bit beyond. More aggressive investors who are focused on growth might allocate less, perhaps three to five percent or even nothing if they’re young and have a very long time horizon.

Within your precious metals allocation, you also need to decide how to split between the different metals and different vehicles. A reasonable starting approach might be seventy to eighty percent gold and twenty to thirty percent silver, with platinum or palladium as optional additions for those who want more diversification within metals.

For implementation methods, you might split between physical holdings and ETFs, or use mining stocks for a portion of your allocation if you want more growth potential and can handle the higher volatility. The key is matching the characteristics of different investment vehicles to your specific goals and constraints.

Tax Considerations and Reporting Requirements

The tax treatment of precious metals is really important to understand because it differs from stocks and bonds in ways that can significantly impact your after-tax returns.

Physical precious metals and ETFs backed by physical metals are classified as collectibles by the IRS. Long-term capital gains, for positions held more than one year, are taxed at a maximum rate of twenty-eight percent rather than the more favorable fifteen or twenty percent rates that apply to stocks.

Short-term gains are taxed as ordinary income regardless.

This tax treatment makes precious metals less efficient for taxable accounts compared to equities, especially for high-income investors. One reason why holding precious metals in an IRA can be attractive is you’re sheltering those less-favorable tax rates within a tax-advantaged structure.

Mining stocks are taxed as regular equities, which means the more favorable long-term capital gains rates apply. This is one of the underappreciated advantages of gaining exposure to precious metals through mining companies rather than physical metals.

When you sell physical precious metals, you need to report the transaction on Form 8949 and Schedule D of your tax return. Dealers are required to file Form 1099-B for certain transactions, particularly when you sell twenty-five or more ounces of gold or silver bars or when selling certain quantities of specific coins.

Even if the dealer doesn’t file a 1099-B, you’re still legally required to report the sale.

The cost basis for precious metals is generally what you paid, including premiums, plus any improvements or expenses directly related to the investment. Keeping good records is essential because you’ll need to document your purchase price when you eventually sell.

Common Mistakes and How to Avoid Them

After covering all these investment methods, I want to highlight some mistakes that repeatedly trip up precious metals investors.

The first major mistake is paying excessive premiums for collectible or numismatic coins when you’re actually making an investment rather than a collecting purchase. Dealers love to sell rare coins with high premiums, but unless you’re knowledgeable about numismatics, you’re better off sticking to investment-grade bullion with low premiums over spot.

Another common error is inadequate storage security for physical holdings. Keeping large amounts of precious metals in an obvious location at home without proper security measures is asking for trouble.

Either invest in a really good, properly installed, and insured safe, or use professional storage.

Overleveraging through futures or margin is another way investors get hurt. The leverage in futures contracts is tempting, but a relatively small adverse price move can wipe out your entire position.

For most investors, leverage and precious metals don’t belong in the same portfolio.

Failing to understand the costs associated with different investment methods is also problematic. When you factor in premiums, bid-ask spreads, storage fees, insurance costs, and management fees, the true cost of precious metals ownership can be substantially higher than it initially appears.

You need to calculate the all-in costs and compare them across different methods.

Panic selling during price declines defeats the purpose of holding precious metals as a long-term store of value. Precious metals are volatile in the short term, and if you sell after a significant decline, you’re locking in losses and abandoning your position just when it might be most valuable to hold.

People Also Asked

How much gold should I own?

Most financial advisors recommend allocating five to ten percent of your total portfolio to gold. This provides meaningful diversification benefits without overconcentrating in non-income-producing assets.

Conservative investors might go slightly higher, while aggressive growth-oriented investors might allocate less.

Your specific allocation should depend on your age, risk tolerance, and overall financial goals.

Is it better to buy physical gold or gold ETFs?

Physical gold gives you direct ownership with no counterparty risk, but comes with storage costs and lower liquidity. Gold ETFs offer superior convenience, instant liquidity, and lower transaction costs, but you don’t actually possess the metal.

Many investors use a combination, holding some physical gold for security and peace of mind, while using ETFs for the bulk of their allocation because of the flexibility and ease of rebalancing.

Are gold mining stocks a good investment?

Gold mining stocks provide leveraged exposure to gold prices, meaning they often move more dramatically than the underlying metal. When gold prices rise, mining company profits can increase by much larger percentages.

However, you’re taking on company-specific risks, such as operational problems, management issues, and production challenges.

Mining stocks work best for investors who can handle higher volatility and want growth potential beyond what physical gold offers.

What is the best precious metal to invest in right now?

Gold stays the most popular choice for most investors because of its established role as a store of value and its relatively lower volatility compared to other precious metals. Silver offers greater price volatility and has both monetary and industrial demand, making it attractive to those comfortable with larger price swings.

For most portfolios, a combination of seventy to eighty percent gold and twenty to thirty percent silver provides reasonable diversification within precious metals.

How do I store physical gold safely at home?

If you store gold at home, you need a high-quality safe that’s securely bolted to the floor or wall. The safe should be fire-rated and weigh enough, or be installed securely enough, so it can’t be carried away.

You’ll also need specialized insurance coverage, since standard homeowners policies typically limit coverage for precious metals to just a few thousand dollars.

Many investors find that professional vault storage is actually more cost-effective and secure than home storage.

Can I hold gold and silver in my IRA?

Yes, you can hold physical gold and silver in a self-directed IRA, but it must meet IRS purity standards and be stored at an approved depository. You can’t keep the gold at home and claim IRA treatment.

Setting up a precious metals IRA requires working with a specialized custodian that handles compliance and storage.

The tax advantages can be significant, especially for larger positions, but you’ll pay custodian fees and storage fees in addition to the cost of the metal itself.

Noble Gold Investments specializes in helping set up gold and silver IRAs—visit https://noblegoldinvestments.com/ to learn more and get a free consultation.

What are streaming companies in precious metals?

Streaming companies provide upfront financing to mining companies in exchange for the right to purchase future production at reduced prices or receive royalty payments. Companies like Franco-Nevada and Wheaton Precious Metals operate this model.

They get exposure to metal prices without the operational risks of actually running mines.

For investors, streaming companies offer a middle ground between owning physical metals and investing in mining companies.

How are precious metals taxed?

Physical precious metals and metal-backed ETFs are classified as collectibles by the IRS, meaning long-term capital gains are taxed at a maximum rate of 28% rather than the 15% or 20% rates for stocks. Mining stocks are taxed as regular equities with more favorable rates.

This tax treatment is one reason many investors hold precious metals in IRAs, where the tax disadvantage doesn’t matter.

Key Takeaways

The best way to invest in precious metals depends entirely on your specific situation, but physical bullion and precious metals ETFs represent the most straightforward approaches for most investors. Physical ownership provides tangible security and no counterparty risk, while ETFs offer superior liquidity and lower transaction costs.

Mining stocks offer growth potential but come with significantly higher volatility, while streaming companies provide a middle ground between metals and miners.

Target allocations typically range from 5 to 10 percent of total portfolio value, with the majority in gold, supplemented by silver. Dollar-cost averaging into positions over time removes timing pressure and builds holdings gradually.

Understanding the tax treatment of collectibles for physical metals and metal-backed ETFs is essential for calculating true after-tax returns.

The combination of low correlation with traditional assets and historical performance during inflationary periods makes precious metals valuable portfolio diversifiers. Match your implementation method to your priorities. If you value security and direct ownership above all else, lean toward physical bullion.

If you prioritize liquidity and flexibility, ETFs make more sense.

If you want growth potential and can handle volatility, mining stocks and streaming companies deserve consideration.

Ready to diversify your portfolio with precious metals? Contact Noble Gold Investments today for expert guidance and competitive pricing: https://noblegoldinvestments.com/

Leave a Reply