Navigating life at 50+, including health, financial wellness, Christian living, diet/fasting, WFH opportunities, and investment options like precious metals, can feel overwhelming in today’s volatile economy. For Christians seeking faith-based retirement guidance, worried about inflation eroding savings, or health-conscious individuals managing chronic conditions through mindful living, diversifying into precious metals IRAs offers a tangible way to protect wealth. As global uncertainties rise—with inflation hovering around 3-4% and market swings impacting traditional stocks—companies like Birch Gold Group and Goldco stand out for helping seniors secure their legacies.

In this comprehensive ‘Birch Gold Group vs. Goldco: An Honest Comparison for Seniors’ comparison, we’ll break down these two leading precious metals IRA providers based on extensive research from sources like the Better Business Bureau (BBB), Trustpilot, Money.com, and CNBC. Both companies specialize in gold, silver, platinum, and palladium IRAs, allowing you to rollover existing 401(k)s or IRAs without tax penalties. We’ll cover their overviews, features, performance, pricing, user suitability, and a final recommendation. Whether you’re semi-retired and exploring WFH income streams or anxious about outliving savings amid health challenges, this guide addresses your pain points with honest, data-driven insights.

Ready to safeguard your retirement? Explore Birch Gold Group’s transparent IRA options today. Get started with Birch Gold Group.

Overview

Birch Gold Group, founded in 2003, is a Burbank, California-based firm with over 30,000 customers. It emphasizes education and transparency, often endorsed by conservative figures like Ron Paul and Ben Shapiro.

Birch focuses on helping everyday investors diversify retirement portfolios with physical precious metals, appealing to seniors who value straightforward, faith-aligned stewardship of finances. Its A+ BBB rating and AAA from the Business Consumer Alliance reflect strong trust, particularly for those transitioning from wealth accumulation to preservation.

Goldco, established in 2006 and based in Woodland Hills, California, has helped Americans place over $3 billion in precious metals. Backed by celebrities like Sean Hannity and Chuck Norris, it prioritizes customer service and seamless rollovers. With an A+ BBB rating and over 8,000 five-star reviews, Goldco targets both beginners and experienced investors, offering buyback guarantees and bonus metals promotions. It’s ideal for seniors seeking hassle-free protection against economic “beasts” like inflation, aligning with biblical principles of wise preparation (Proverbs 21:20).

Both companies address seniors’ anxieties: outliving savings in shaky markets, health issues limiting traditional work, and finding flexible WFH opportunities. Precious metals IRAs provide inflation hedges—gold has averaged 10% annual returns over the past decade—while allowing tax-advantaged growth. However, Birch leans toward affordability for smaller investors, while Goldco excels in high-touch support.

In a world where AI-driven markets and geopolitical tensions threaten stability, these firms help integrate precious metals into life at 50+, supporting financial wellness alongside Christian living and health-focused habits like fasting.

Feature Comparison

When comparing features, both Birch Gold Group and Goldco offer self-directed IRAs compliant with IRS rules, allowing holdings in gold, silver, platinum, and palladium coins/bars meeting purity standards (e.g., 99.5% for gold). They partner with custodians such as Equity Trust and STRATA, and depositories such as Delaware Depository or Brink’s, for secure storage.

Birch Gold Group stands out for its educational resources: free info kits, webinars, and market updates on precious metals trends. It offers flexible custodian/depository choices, including segregated storage, and emphasizes non-IRA direct purchases for home delivery. Birch’s “Backed by Birch” program includes exclusive coins like the 1/3 oz Gold Britannia, appealing to collectors. For seniors, its low-effort setup suits those managing chronic conditions, with no-pressure consultations.

Goldco shines in customer perks: up to a 10% bonus on silver for qualifying purchases ($50k+), the highest-price buyback guarantee, and a free Wealth Protection Kit. It provides white-glove rollover assistance, handling paperwork for 401(k)s or IRAs. Goldco’s inventory includes premium coins like American Eagles and Canadian Maples, with options for non-IRA buys. Its focus on beginners makes it user-friendly for pre-retirees exploring WFH side gigs in metals trading.

Key differences: Birch offers more depository options (five vs. Goldco’s two), while Goldco provides better promotional incentives. Both ensure IRS-approved metals, but Goldco’s app-based tracking edges out for tech-savvy seniors.

Protect your legacy with Goldco’s bonus silver offer. Start your Goldco IRA rollover now.

Performance Analysis

Performance in precious metals IRAs isn’t about short-term gains but long-term stability. Gold has outperformed stocks in inflationary periods, rising 500% since 2000, while silver offers volatility with industrial demand growth (up 20% in 2025 due to green tech).

Birch Gold Group’s track record: 4.6/5 on Trustpilot (252 reviews), 4.7/5 on Google (1,168 reviews), and A+ BBB with minimal complaints (8 in 3 years, mostly resolved). Customers praise transparency and education, but some note high premiums on coins (30-60% over spot), which can lead to “underwater” starts. Birch has helped over 39,000 Americans and has strong endorsements for its ethical practices. In 2025, it navigated market dips well, with clients reporting annual gains of 8-12% on gold holdings.

Goldco’s performance: 4.6/5 on Trustpilot (1,724 reviews), 4.9/5 on Google (3,007 reviews), and an A+ rating from the BBB with 65 complaints (mostly pricing disputes, resolved). Over 8,000 five-star reviews highlight exceptional service and buyback programs, but critics note hidden premiums and sales pressure. Goldco placed $3B+ in metals, earning awards such as Money.com’s Best Customer Service (2025) and an Inc. 5000 ranking. Clients saw similar 8-12% gold returns, with bonuses boosting effective yields.

Both firms deliver solid IRA performance, but Goldco edges in customer satisfaction volume, while Birch wins on complaint resolution speed. For seniors, neither guarantees returns—precious metals averaged 7-10% over 20 years—but they hedge against 2026’s projected 3% inflation.

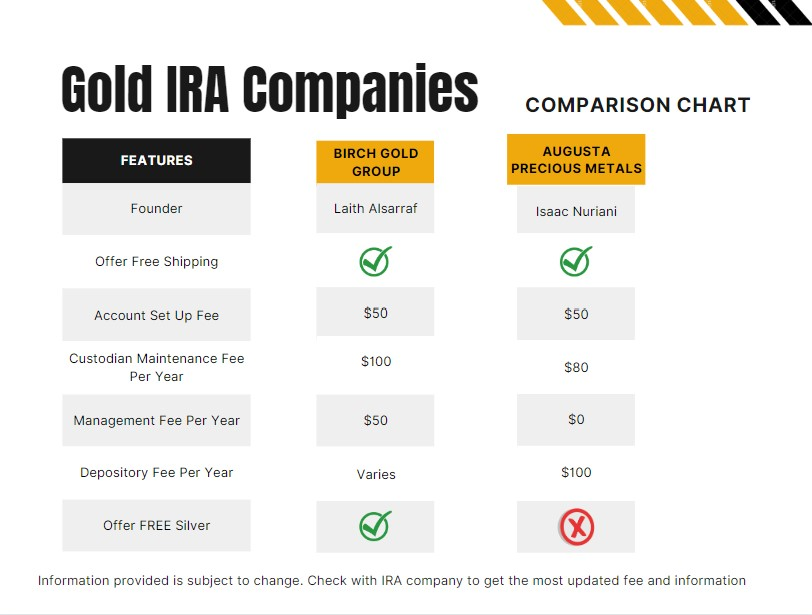

Price Comparison

Costs are crucial for fixed-income seniors. Both charge flat fees, avoiding the erosion caused by percentage-based fees.

Birch Gold Group fees: $10,000 minimum investment. One-time setup: $50; wire transfer: $30. Annual: $180-235 (custodian $80-125 + storage $100). First-year fees waived for deposits of $50k+. Premiums on metals: 3-5% over spot for bars, higher for coins (up to 45% on specialty items). Total first-year cost for a $50k IRA: ~$200- $ 300 after waivers. Buyback: Competitive, no fees.

Goldco fees: $25,000 minimum (waivable for some). One-time setup: $50; wire: $30. Annual: $225 (administration $125 + storage $100). First-year total: $275. Premiums: 3-5% on bars, 30-60% on premium coins. Promotions: Up to 10% bonus metals on $100k+. Buyback: Highest guarantee, no fees. Total for $50k: ~$275 first year.

Birch is more affordable for smaller investors with lower min and fees, while Goldco’s bonuses offset costs for larger rollovers. Both avoid high ongoing percentages, but watch premiums—research spot prices to avoid overpaying.

Diversify affordably with Birch Gold’s waived fees. Claim your free Birch Gold info kit.

Best For Different Users

Tailoring to your needs is key in life at 50+.

For Christians aged 50-70 seeking faith-based guidance, Birch Gold Group aligns better with conservative, biblically inspired endorsements (e.g., Ron Paul on stewardship). Its educational focus supports prayerful decision-making.

Pre-retirees 55-70 concerned about inflation: Goldco’s buyback guarantee and bonuses suit those rolling over larger 401(k)s, providing peace amid market volatility.

Health-conscious 50+ managing chronic conditions: Birch’s lower minimum and flexible options fit those with limited energy for complex setups, allowing focus on diet/fasting for wellness.

Semi-retired professionals seeking WFH income: Goldco’s user-friendly platform enables side gigs like metals reselling, with quick rollovers freeing time for remote work.

Birch for budget-conscious or beginners; Goldco for service-oriented or higher-net-worth seniors.

Secure inflation protection with Goldco’s buyback program. Get your free Goldco Wealth Kit.

How Metals Selection Shapes Your Strategy

Both companies offer gold, silver, platinum, and palladium. But their emphasis differs in ways that reveal their client base.

Goldco actively promotes diversification across all four metals. Their specialists will discuss portfolio allocation strategies that include platinum and palladium alongside more traditional gold and silver holdings.

If you’re someone who wants exposure to industrial precious metals that have different market dynamics than monetary metals, Goldco’s approach provides more guidance in that direction.

Birch Gold Group focuses predominantly on gold and silver in its educational materials and product offerings. This reflects what most investors actually want.

Gold and silver have the longest track record, the most liquid markets, and the clearest role in a retirement portfolio as inflation hedges and stability anchors.

I’ve found that most investors over 60 aren’t really interested in the complexity of platinum and palladium markets. They want to understand gold’s historical role as money and silver’s dual nature as both monetary metal and industrial commodity.

Birch’s educational focus aligns with that practical approach.

Within the gold and silver categories, both companies offer a range of products. American Eagles, Canadian Maple Leafs, and various bars all meet IRS requirements for precious metals IRAs.

Your specialist at either company will walk you through the options and explain the trade-offs between government-minted coins and private-mint bars.

Government coins typically carry higher premiums but offer better liquidity when you eventually sell. Private bars cost less upfront but may have slightly wider bid-ask spreads when liquidating.

For most retirement investors, a mix of both makes sense.

Final Recommendation

In 2026’s uncertain landscape—with the Fed cutting rates and geopolitical risks—both Birch Gold Group and Goldco offer reliable precious metals IRAs for seniors. Birch excels in transparency, lower entry points, and education, making it our top pick for most users, especially those with $10k-50k to invest. Goldco wins for premium service and incentives, ideal for larger portfolios.

Ultimately, choose Birch if affordability and ethics matter most; Goldco if seamless support is key. Consult a financial advisor, as metals carry risks like price volatility. Start small, diversify wisely, and integrate with your holistic life at 50+ strategy.

Don’t wait—fortify your retirement today. Explore Birch Gold Group options or begin with Goldco.

Frequently Asked Questions

Can I roll over my 401k into a gold IRA without penalty?

Yes, you can roll over funds from a 401(k) into a gold IRA without triggering taxes or penalties, as long as the transfer happens directly between custodians. This is called a direct rollover or trustee-to-trustee transfer.

The funds never pass through your hands, so the IRS doesn’t consider it a distribution.

Both Birch Gold Group and Goldco handle the paperwork and coordinate with your existing 401(k) administrator to ensure the transfer is completed correctly. The process typically takes two to four weeks.

What is the minimum investment for a gold IRA?

The minimum investment varies by company. Birch Gold Group needs a $10,000 minimum to open a gold IRA, while Goldco needs $25,000.

These minimums represent the initial amount you need to fund your account.

After your account is established, you can typically add to it in smaller increments, though each company has specific policies about subsequent contributions. If you have less than $10,000 to invest, you’ll need to save more before opening a gold IRA or consider other investment options.

How much does it cost to store gold in an IRA?

Annual storage fees for gold IRAs typically range from $200 to $300, though the exact amount depends on your account size and which company you choose. This fee covers secure storage at IRS-approved depositories, comprehensive insurance coverage, regular audits, and account administration.

Birch Gold Group charges a flat annual fee regardless of account size, which benefits larger accounts.

Goldco’s fees are competitive and similar in total cost. Storage fees are separate from custodian fees, which cover the IRA administration itself.

Can I take physical possession of gold in my IRA?

You cannot take physical possession of gold held in your IRA without triggering a taxable distribution. The IRS requires that precious metals in an IRA stay in the custody of an approved depository.

However, when you take a required minimum distribution or choose to liquidate holdings, you have two options: sell the metals and receive cash, or take physical delivery of the actual metals.

Taking physical delivery satisfies the distribution requirement, but the fair market value of the metals is treated as taxable income for that year.

Is a gold IRA better than a traditional IRA?

A gold IRA serves a different purpose than a traditional IRA invested in stocks and bonds. Traditional IRAs provide growth potential through equity markets and income through bonds.

Gold IRAs provide inflation protection and portfolio diversification through tangible assets.

Most financial advisors recommend holding 10-20% of your retirement portfolio in precious metals as a hedge, keeping the remainder in traditional investments. Gold IRAs work best as part of a diversified strategy rather than as a complete replacement for traditional retirement accounts.

Does Goldco charge setup fees?

Goldco charges setup fees in the first year that cover account setup, paperwork processing, and initial coordination with your existing custodian. These first-year costs are typically higher than subsequent-year costs, but Goldco often partially offsets them through promotional offers.

After the first year, annual fees settle into the standard range of about $225.

When comparing total costs, factor in the promotional bonuses Goldco offers, as they can significantly offset first-year expenses.

What happens to my gold IRA when I turn 73?

When you turn 73, your gold IRA becomes subject to required minimum distributions, just like traditional IRAs. You must begin withdrawing a percentage of your account value each year based on IRS life expectancy tables.

You can satisfy these distributions either by liquidating a portion of your metals and receiving cash, or by taking physical delivery of the actual metals.

Both Birch Gold Group and Goldco help you plan for required minimum distributions years in advance, so the process doesn’t create surprises or force rushed decisions.

Can I hold silver and gold in the same IRA?

Yes, you can hold many types of precious metals in the same IRA. Most investors include both gold and silver, and some add platinum or palladium.

Holding a variety of metals provides diversification within your precious metals allocation, as different metals respond differently to economic conditions.

Your specialist will help you decide a suitable allocation based on your goals and risk tolerance. The same annual fees typically cover storage for all metals in your account, regardless of how many different types you hold.

Key Takeaways

Birch Gold Group’s $10,000 minimum makes precious metals IRAs accessible to a wider range of investors and particularly suits those new to gold and silver investing who want to start gradually.

Goldco’s $25,000 minimum positions them for investors with substantial retirement savings ready to deploy, and their promotional bonuses add immediate tangible value to larger accounts.

Fee structures between the two companies are remarkably similar in total annual cost, but Birch Gold’s transparency and flat-rate approach benefit larger accounts and investors who prioritize knowing exact costs upfront.

Goldco’s Highest Price BuyBack Guarantee provides valuable liquidity assurance that becomes increasingly important as you approach retirement age and required minimum distributions.

Customer service philosophies differ significantly. Goldco emphasizes effective white-glove execution, while Birch Gold prioritizes education and long-term relationship building through knowledge transfer.

For accounts under $50,000, Birch Gold generally delivers better overall value through lower minimums and transparent pricing. For accounts over $75,000, Goldco’s promotions and guarantees create superior long-term benefits.

Leave a Reply